After spending time analyzing our finances and starting a new routine, categorizing our expenses into needs and wants either in a spreadsheet or on paper is essential. Needs are what we need to live (roof over our heads, food, utilities, clothing, etc.). Wants are items or services which bring us emotional pleasure. This is the category we want to closely observe.

Wants

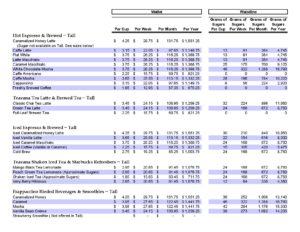

One particular want that is common is Starbucks. Yes, I know everyone who talks about money targets Starbucks. I wonder why? It’s quick, easy, delicious, but is it necessary to pay roughly $22 a week on a tall caffe latte? A venti latte is around $29 a week. And, I’m not even picking an expensive item. By the end of the month, we would have spent nearly $100 a month on a tall caffe latte a day. Where else might this money have gone? If we examine our spending habits, we can filter out frivolous spending and start making wiser choices.

Emotional Pleasure

Another consideration is the emotional pleasure we seek when we buy unnecessary items and services. It is important to ask ourselves: Why are we purchasing these items? What are we trying to fulfill? What is going on inside that makes us want to spend money unconsciously? When we investigate in this matter, we might realize we are upset and trying to ignore a difficult situation by stifling it with a sugary drink. Sure the temporary relief is great, but aren’t we prolonging the inevitable?

Facing Our Discomfort

Instead of pushing away our difficulties, we could face them. Taking a couple of deep, conscious breaths can relax our mind. We perhaps can go even further and discover where in our bodies are we experiencing the tension and sit with the discomfort until it naturally diminishes; thus, establishing a calm attitude toward our circumstances. Out of this stillness, we could objectively listen to our thoughts and question if this purchase is necessary. Interacting with the mind and body in this way, we heighten our emotional awareness and lessen unhealthy spending habits.

Continuing on our journey, we could spend 10 minutes a day to incorporate this mindful exercise as it will start the path of cultivating a deeper relationship with our finances and experience a more peaceful life. We could further extend our practice to spending 10 minutes a day with our budget.

Our Wallet & Our Waistline

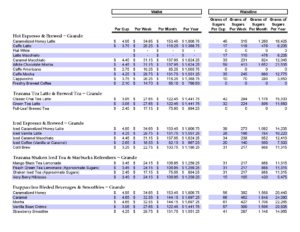

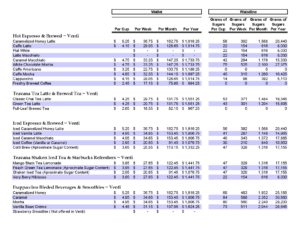

I went to my local Starbucks to price their drinks. I created the spreadsheets below showing the effects of Starbucks on our wallet and the sugar content on our waistline. I recommend watching the movie Fed Up to learn more about the effects of sugar on our health. It’s available on Amazon Prime Video.

See the yearly expense and sugar content on a Venti Caramel Frap:

Seeking Help

If you are depressed, anxious, or have panic attacks, find a health professional who can help you.

Substance Abuse and Mental Health Services Administration (SAMHSA) National can provide free referrals. They are open 24/7, 365 days a year.

If you are experiencing suicidal thoughts, please contact 988 for help. The calls are free, confidential, and they are open 24/7 to help you navigate difficult emotions.

Attend a Workshop

If you are interested in attending a live webinar on improving your routine, please visit my events.

Related Posts